Publications

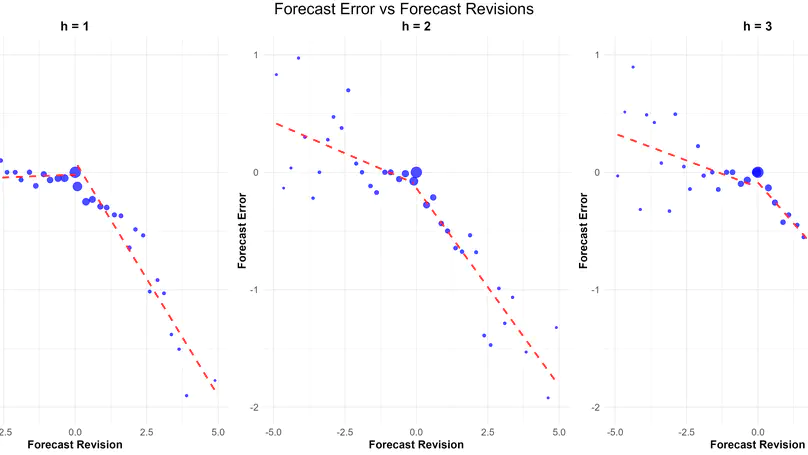

Using a large cross-country dataset covering over 150 countries and more than 10 macroeconomic variables, this study examines the consistency of IMF World Economic Outlook (WEO) forecasts with the full information rational expectations (FIRE) hypothesis. Similar to Consensus Economics forecasts, WEO forecasts exhibit an overreaction to news. Our analysis reveals that this overreaction is asymmetric, with more measured response to bad news, bringing forecasts closer to the FIRE benchmark. Moreover, forecasts align more closely with FIRE hypothesis during economic downturns or when a country is part of an IMF program. Overreaction becomes more pronounced for macroeconomic variables with low persistence and for forecasts over longer horizons, consistent with recent theoretical models. We also develop a model to explain how state-dependent nature of attentiveness may drive this asymmetric overreaction.

How does rational inattention interact with financial frictions? I provide new empirical evidence from survey data that suggests that the answer to this question likely plays an important role in understanding macroeconomic dynamics. In a simple model, I show that financially constrained firms will generally choose to be more attentive to economic conditions, consistent with my empirical evidence. Embedding this mechanism into a DSGE model, I show that the aggregate response of investment to a monetary policy shock hinges on this interaction. The model also predicts that credit-constrained firms ultimately reduce their investment after an expansionary shock, a prediction that I confirm empirically.